I have to admit that it’s a little awkward going on a date with a woman just to get asked “so… what do you do for work?”

i have made the calculated decision to be a jobless bum forever usually flickers through my mind before I settle on something like “well, actually, I’m sitting out my noncompete still… that’s right, I know it sounds crazy, but my old employer is actually paying me to not work… yeah, hahaha I know! ahahahaha…”

Whenever I do admit to people that I’m already retired as a 31 year old, they either stare at me like I have two heads or express concern: “What will you do all day? You’re not going to be bored? Aren’t you giving up a lot of money by not working? What happens if you run out of money? How will you feed your family?”

This post is for all of you annoying people.

Feasibility

This past May I got a pretty cool opportunity to go to F1 Miami and hang out in Aston Martin’s VIP suite as part of a trader outreach program sponsored by Coinbase. I’m not much of a crypto trader myself, but was excited to go to catch up with a buddy of mine who was a high volume player on their exchange and was also supposed to go.

Unfortunately, he couldn’t make it because of a last-minute business meeting, so I ended up mingling with the other attendees instead.

One of them – let’s just call him Jeff – described himself as a quant running a quantitative crypto strategy on a group of managed accounts. He was around my age and couldn’t believe that I retired so early.

I asked Jeff if he had “a number” – for whatever reason, many people in finance pledge to retire after hitting a magic number – and he balked at the concept: “I wouldn’t ever feel financially secure enough to retire early. Maybe if I had a hundred mil or something.”

wow, this crypto guy must have a high-flyer lifestyle, I thought before I prodded him about what his monthly expenses were.

Jeff paid 3k a month for a studio apartment in New York. He tried to cook at home so food costs were a couple of hundred bucks a month. Jeff estimated that his total costs were under 50k a year as a single man. He didn’t like “wasting” money.

what. the. fuck. I was completely flabbergasted. Even if Jeff budgeted for another 100 years of life, stuck everything in some sort of bonds returning 0 percent real return after inflation (this is exceptionally conservative – TIPs have something like a 2% real yield right now), and doubled his current expenses he would still only need 10 million to retire. Lobbing out 100 million – especially as a self-styled quant – was a clear indicator that he never even remotely considered the possibility of retiring early. And why would he? Trends in America are such that a significant number of people aren’t able to retire at all anymore, let alone early. If you’ve never seen anyone pull it off and you were raised in a typical working class family home, your heuristics about how much money you “need” to live are probably quite off. Instead, the heuristic most people have is that you need to work to live.

To be fair, as a mathematically inclined person, Jeff should know better (I promise I’m not making this story up, by the way!) Both equity and bond markets deliver substantial real (that is, post-inflation) returns which compound quite dramatically over time.

The FIRE (Financial Independence, Retire Early) movement that has been fairly prominent since 2010 or so and leans on this fact heavily. The basic principle is that you accumulate some amount of capital, stick it into a mix of equity and fixed income, and take out money from your savings every year to live.

How much capital is enough? A classic rule that is cited among these circles is the “4% rule”, which basically states that if you withdraw an inflation-adjusted 4% of your initial capital, you should never run out of money during your retirement. The basis for this claim is the famous 1998 Trinity study, which took various 30-year return sequences from actual historical data of a 75/25 stock/bond portfolio.

Many adherents adjust this 4% down – anywhere in the 2-3.5% range – due to the fact that they expect their early retirement will last longer than 30 years, or due to much more conservative estimates about future returns and inflation rates. That’s usually as far as most people bother to go to understand the details.

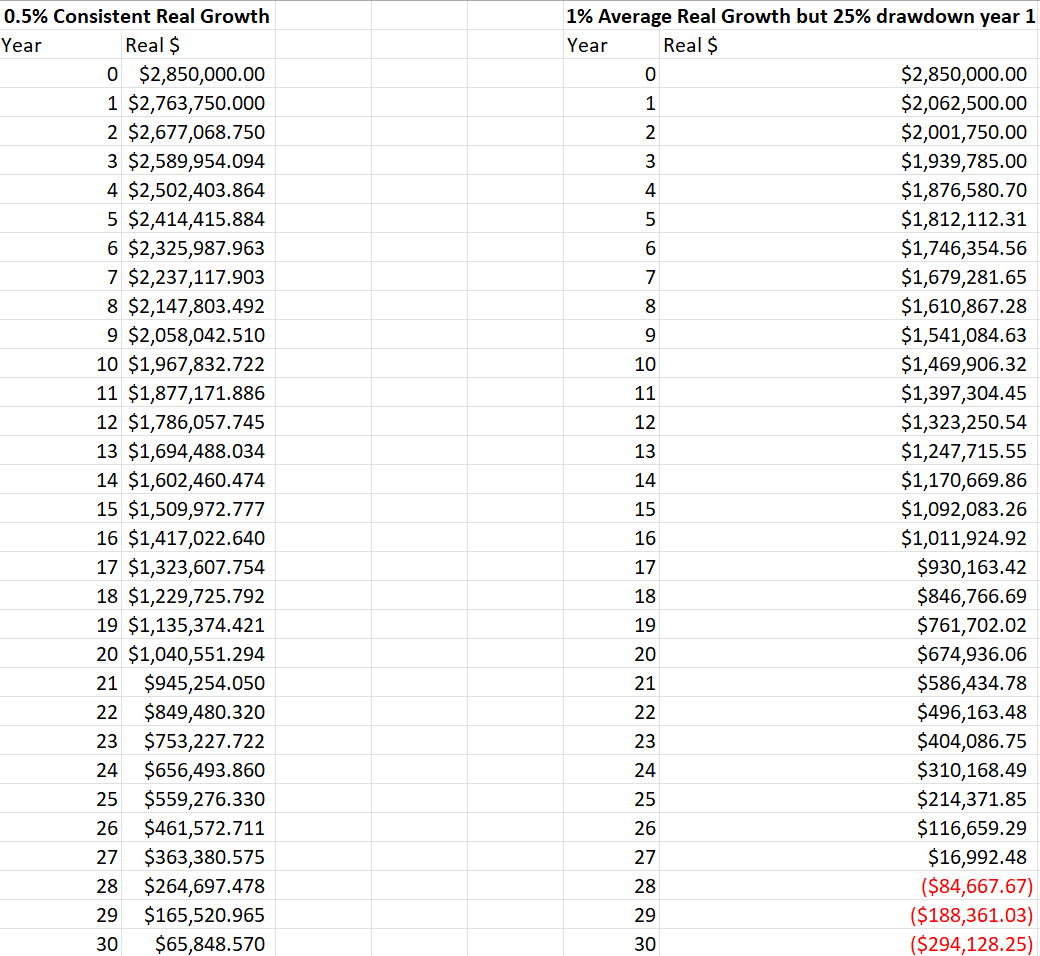

For starters, it’s important to understand what a failure case looks like in practical terms. Let’s say we want to maintain a real income of 100k in retirement and use a slightly more conservative 3.5% rule to withdraw money, so we retire when we hit a net worth of $2,850,000:

The numbers shown are in real dollar terms. In case 1, suppose our portfolio achieves 0.5% real growth year consistently (bearing in mind this is analogous to the worst 20 year annualized growth rates in American equity history.) In case 2, suppose our portfolio experiences a 25% drawdown on year 1, and then returns 2% consistently in real terms, for an average 30 year growth rate of 1% in real terms. In case 1, we have enough money to last a 30 year retirement. In case 2, despite have double the average growth rate, we run out of money. This is what is called sequence-of-returns risk, and highlights the fact that what the early retiree is really concerned about is not just poor portfolio returns, but specifically poor portfolio returns early into retirement.

This is actually great news for early retirees because early drawdowns are the easiest to react to. If you lose a bunch of money the first few years of your retirement, it’s still not too difficult to get back to work and start accumulating again. In practice real life affords a lot more flexibility than the rigid guidelines of the studies.

Another place where some retirees have more flexibility than the prescribed plans is in spending. Let’s say you are a particularly wealthy retiree inspired by one of these types of subreddits and choose to retire once you join the 8 figure club.

This likely means you have some slack in your budget. Maybe you can move to a lower cost of living area to reduce housing costs, since you are no longer tied to a geographic location due to job availability. Or you can tighten your belt when times are tough to only do one vacation instead of three. Economy vs first class. The list goes on. So instead of spending a fixed inflation adjusted amount as prescribed by the Trinity study, spend a dynamic amount based on current wealth, with maybe some added bounds.

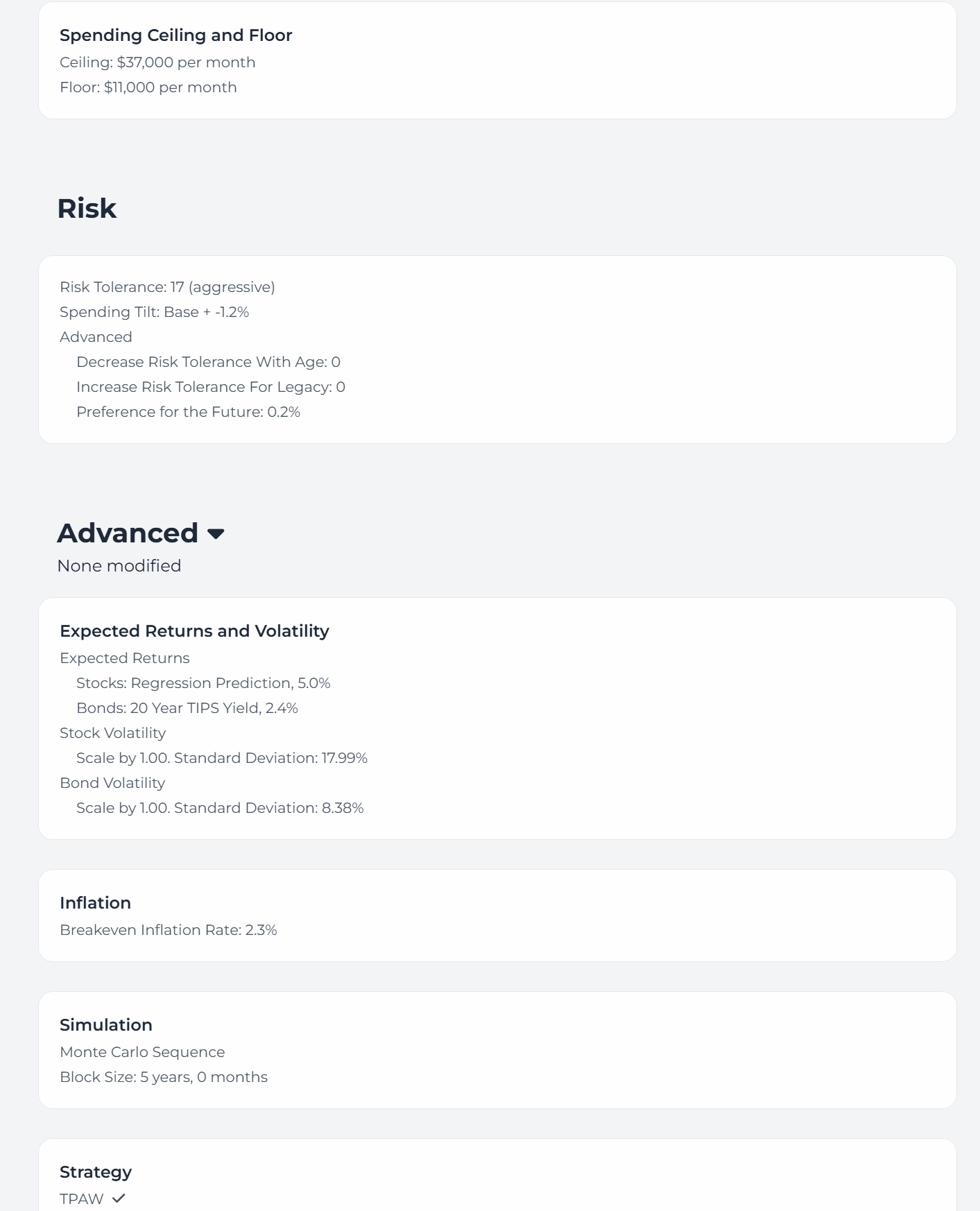

One awesome resource to play around with is tpawplanner. You can run Monte Carlo simulations with a ton of parameters, sampling from adjusted historical data to produce expected returns that you think are reasonable as well as using a variety of spending strategies. Let’s say we start with 10 million dollars, assume we get 80% of the social security payments we are owed from age 70, and start at age 31 (my age now.) I’ve picked the following parameters to simulate a retirement that ends at age 90:

As we saw earlier, average real stock returns historically have been 8.6%, so this is reasonably, though not especially, conservative. If anything, things are looking better than ever for asset owners, with the federal government offering all sort of capital gains tax advantages, subsidization of equity growth with the devaluation of the US dollar, and economic stories that may genuinely increase the GDP growth rate (eg AGI.)

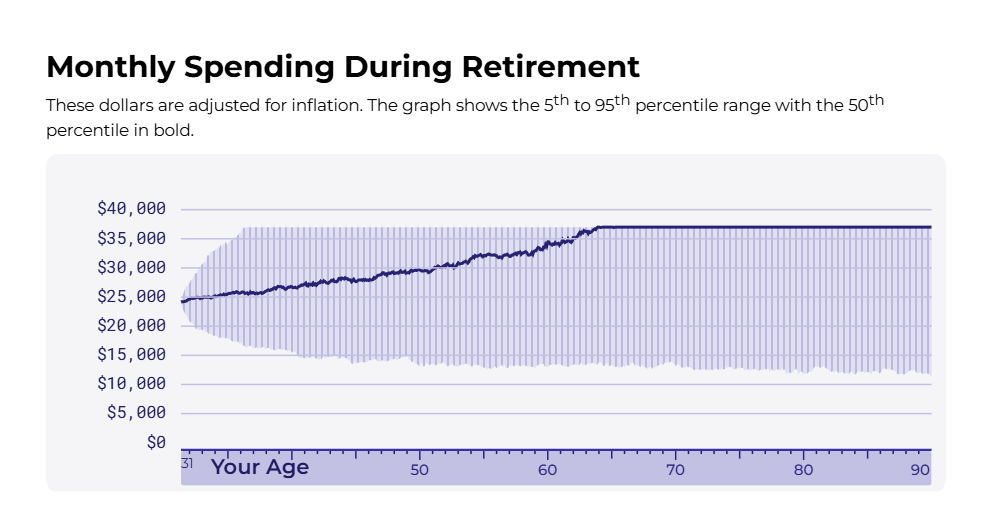

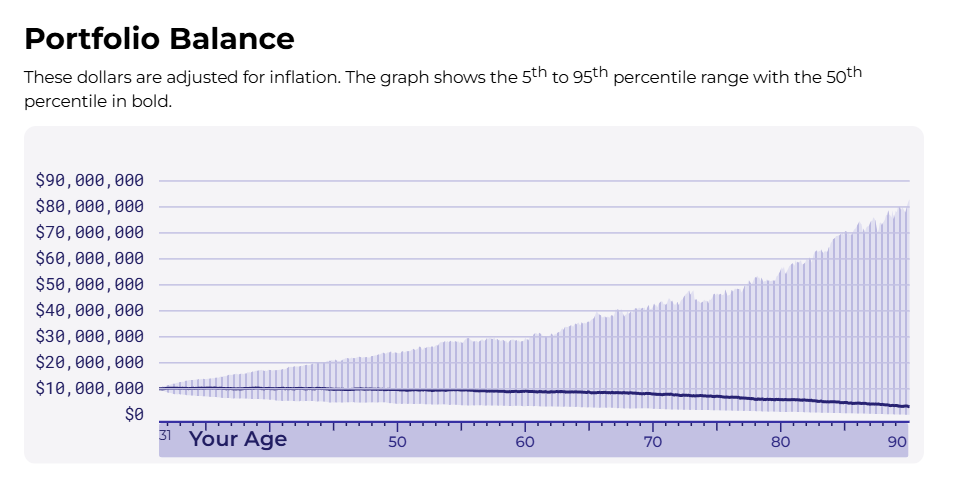

Anyway, here’s what the simulation outputs look like:

So under these parameters, you don’t run out of money by age 90 in the bottom 5th percentile simulation, the median case is that you leave a substantial legacy to your children, and there are upside cases where your wealth grows as much as 8 times even after adjusting for inflation. Your spending is not too shabby1 as the modal case is that you can spend as much as 24k a month at the start that eventually grows to a whopping 37k a month. Bear in mind that this is for a 60 year retirement, twice as long as the Trinity study, and we are using much more conservative return assumptions!

Point of order: this 24k a month is much better than receiving a 24k a month salary. For starters, you will have to pay substantially lower taxes on it. At the beginning, while your capital gains are still low, taxes will be truly negligible (possibly literally zero!), and they will eventually climb to something on the order of 15-20%, depending on what state you live in and what percentage of your savings was contributed in pre-tax dollars. Furthermore, while working, people still squirrel away savings. At higher income levels maybe something like 25% of gross income is appropriate.

So what is this 24k a month of consumption equivalent to in terms of salary? I currently live in Chicago, so let’s take those tax assumptions. If you’re part of a married couple who have a household income of 550k, your total effective tax rate will be on the order of 31%, and after saving 25% of your gross income will be left with a bit over 280k, comparable to what we were looking at above.

Granted, there are some other considerations – for example, retirees need to pay for their own health insurance which might easily cost something like 25k for a family – and maybe that takes the equivalent household income down to something closer to 500k. Still… that’s a top percentile individual income and maybe a second percentile household income. Quite the comfortable lifestyle.

For me personally, these numbers are more than enough. Even my lavish one month trip to Japan this year only cost me 10k and some airfare miles, and that was with staying at some fancy ryokans and eating some Michelin-rated dinners. Although future kids can be somewhat expensive, because I don’t have to be located in a major metropolitan city for a job, I’m not limited to extremely expensive private schooling to get a good education. I’ve never been interested in things like cars or designer clothes, so giving up years of my life just so I can afford even more luxury goods just isn’t worth it.

In the worst case scenario where you drawdown hard immediately after retiring, I suppose you have to have a Come-To-Jesus moment where you need to decide whether you settle for the mere2 upper-middle class lifestyle of 15k a month of consumption (equivalent to maybe a 300k household income) or go back to work because those numbers make you cringe and go

that’s it?

Rewards

I ultimately pulled the trigger on quitting my job when my dad, who had stage 4 pancreatic cancer, was pulled out of the clinical study he was participating in. Unfortunately, his health had been rapidly deteriorating and his markers no longer met the study’s inclusion requirements. Every few weeks I would travel back home to the DC area to help my parents as well as just spend some precious moments with him, and I felt very fortunate that I had the financial means to leave work and do so. Those months with him were worth far more than any salary I would have garnered during that time.

My father confided to me that he regretted that he was barely able to enjoy retirement – Dad was first diagnosed only a year after he submitted his resignation from work – and his last words to me when nobody else was in the room were “remember to have fun!”

I’ve been taking these words to heart since. A lot of people ask me if I’m bored now that I don’t have steady work, and honestly I don’t have the theory of mind necessary to understand what place their question even comes from. Even in a 24 hour life, there are simply not enough hours during the day and days in the year to do everything I want. A light sampling of things I’ve done in my first year or so:

Learning Guitar

While I’ve been told I have a pretty good ear for music since a young age, I had never actually learned how to play any instruments, and to do so had always been on my bucket list. I love the sound and feel of acoustic guitar (probably influenced from all the Russian Bard music played around me during my childhood) so I got a acoustic Washburn guitar and signed up for lessons at the Old Town School of Music. Acoustics are harder for beginners to learn to play due to their higher action, but because I had the free time to build up the finger strength, this was no problem at all. Not only have I gotten fairly decent at finger picking, taking classes at an old, well-known music school helped scratch that collegiate itch and there was a bit of nostalgia walking down winding hallways full of classrooms.

Learning Japanese

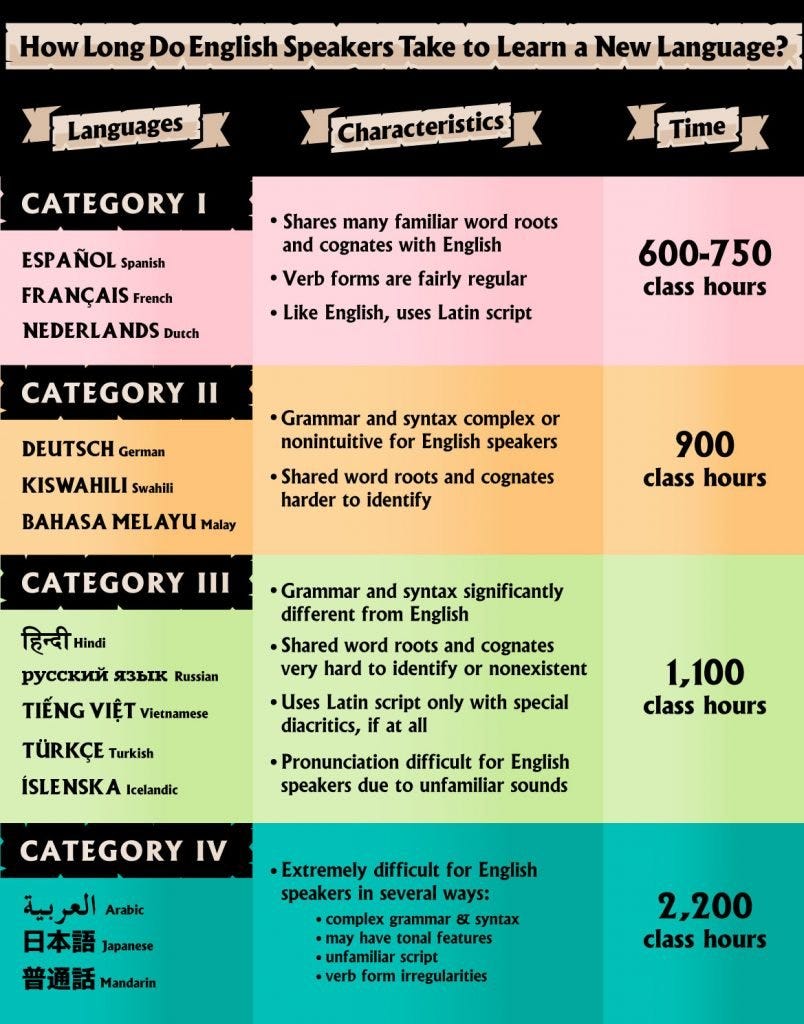

Like many soulful Western young men, I had a mecca to Japan in my early 20s and fell in love with the country, the food, and the culture. As soon as I came back to the States I immediately went to Amazon and purchased several textbooks and stacks of graded readers. Unfortunately, while I was working they pretty much just sat and collected dust. It turns out FSI Category 4 languages take a LOT of consistent practice to master.

This makes for an excellent time-sink and hobby when you actually have free time and flexibility! I was also pleasantly surprised that fears about languages only being acquirable in your youth while your brain is plastic were somewhat overblown, given the confounding factor that adults have a lot of responsibilities and not a lot of time to complete them all in. In retirement I could find the time to regularly complete my Anki cards while consuming natural media and work on grammar lessons, no sweat.

Extended Travel

Incidentally, my study of Japanese and especially Kanji were invaluable on a month long trip I took to Japan this year.

This was an absolutely epic trip, and only the second time I’ve visited Japan. Until my retirement the longest trip I’ve ever done was over 10 consecutive days, so this was almost three times as long! Needless to say, I would never be able to do a month long trip while I was working.

Spontaneous Travel

Even more exciting was the spontaneous travel I’ve been able to do. Only two weeks after I came back from my Japan trip, I got a notification that Lufthansa had some next-day First Class award availability to Frankfurt, and the weather over the next two weeks in Germany/Netherlands area looked to be pretty good. On top of that, Tulips were in peak bloom, and I’ve always wanted to see the tulip fields up close. So I packed my bags, got the ticket, and rented a bike when I landed in Frankfurt. Riding along the Rhine river and picking places to stay at night-by night as I went was such a fun experience and I definitely want to do something similar again next year.

Meeting New People/Dating

This may or may not come as a surprise, but I’m a pretty introverted person from the perspective that social experiences usually require a fair bit of energy from me. This meant that while I was working, I would have very little desire to meet new people after work, both in a platonic and romantic sense. Since I’m no longer grinding at work, I have a lot more energy to go out and pursue social activities. I’ve been pleasantly surprised by how much fun I’ve had meeting people off of Twitter and how much more excited I am to chat up strangers in real life now that I’m not so tired all the time!

Physical Activities/Fitness

I’ve been a lot better about doing physical activity and not sitting around near a computer all day compared to when I was working. I’ve tried out running, biking, and lifting weights, and plan to make an even bigger push on this when I move to Boston.

And some more stuff I plan to pick up in Boston:

Sailing

This is pretty straightforward. They’ve got a bunch of sailing clubs down by the Harbor and the Charles River, and I want to get good enough so by the end of next summer I could maybe take a boat out to Cape Cod and avoid all that nasty highway traffic.

Reading

When I was a kid in middle school and high school, I used to go to the library every other week and pick out 5-7 books to read, usually a non fiction book, a fantasy book, a science fiction book, a book from the “classics” section, and maybe a few others. Nowadays my reading diet is downright paltry in comparison and I can feel my attention span slipping away. I want to stem the tide somewhat! Moreover, the Boston Athenaeum looks incredibly cool and I can see it being a cool third place to hang out at and maybe meet some like-minded folks.

So yeah. As you can see I’m very very busy and that’s why I didn’t have the time to immediately publish this Substack post as soon as I hit 1,000 subscribers as promised, and definitely not because I’m lazy and a procrastinator. What should I write about next?

i am being facetious here this is obviously an obnoxiously large sum of money

guys seriously can you tell when i’m cynical and dry when i use proper grammar and paragraphs or no

good read, good insight, almost inspiration. the light at the end of the wage slave tunnel is dim yet still shining

sorry for your loss

I'm not in your position, but I can totally relate to being dumbfounded by the "wouldn't you get bored?" question. The cliché is true, only boring people get bored!